Andrew Lacey

Managing Principal

If a company in liquidation makes a payment to an unsecured creditor during or prior to entering into liquidation, the liquidator may flag that transaction and if necessary, seek a determination from the Court that the payment is an ‘unfair preference’ pursuant to section 588FA of the Corporations Act 2001 (Cth), because that creditor has received an advantage over other creditors. But what happens when, instead of the company in liquidation paying the creditor directly, it instructs or authorises a related third party to pay the debt?

In other words, could a payment from a third party constitute an unfair preference payment within the meaning of section 588FA?

Section 588FA (1) of the Corporations Act 2001 (Cth) (the Act) provides that a transaction is an unfair preference given by the company to a creditor if, and only if:

even if the transaction is entered into, is given effect to, or is required to be given effect to, because of an order of an Australian court or a direction by an agency.

If a transaction is found to be an unfair preference, the Court may make orders compelling the creditor to return the funds or property to the company in liquidation, or order the creditor to pay an amount that reflects the benefit that the creditor has received due to the unfair preference.

A creditor may resist an unfair preference claim provided they had come to the transaction in good faith and had no reasonable grounds for suspecting that the company was insolvent (nor would a reasonable person suspect the company was insolvent). This is known as the “good faith” defence.

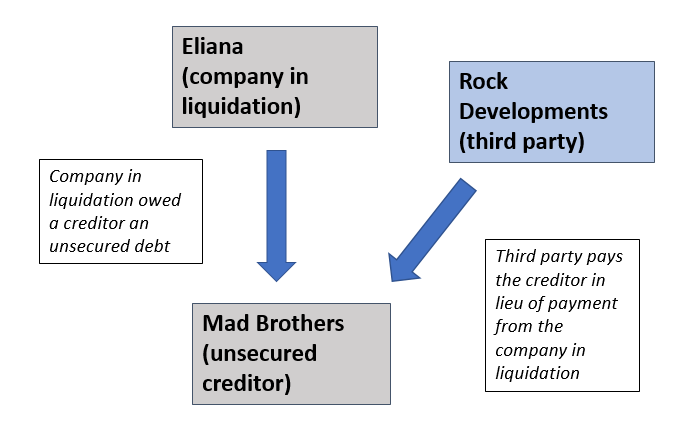

In the recent decision of Cant v Mad Brothers Earthmoving Pty Ltd [2020] VSCA 198, the Supreme Court of Victoria, Court of Appeal, had to consider whether a payment made from a company referred to as Rock Developments (third party) to Mad Brothers (unsecured creditor) in satisfaction of an unsecured debt owed to Mad Brothers by Eliana (company in liquidation) was an unfair preference.

That is, could the payment be an unfair preference even though the payment came from a third party, Rock Developments, and not from the company in liquidation?

To further muddy the waters, the sole director of the company in liquidation was also the sole director of the third party company that made the payment, so there was an inference that as the sole director he had ratified or authorised the payment from the third party.

The three key questions the Court considered were as follows:

The Court was satisfied that the company in liquidation was a party to the transaction on the grounds that there appeared to be an inference that the company in liquidation and the third party that made the payment had an ‘interdependent financial relationship’. For instance, the ledger of the company in liquidation was updated to reflect that the third party had made the payment, which was not contested.

The Court was satisfied that the unsecured creditor had received more than it would have obtained if it had to prove its debt in the winding up. The more significant issue for the Court was whether the payment was ‘from the company’ (that is, the company in liquidation) within the language of the section.

In reviewing the authorities, the Court concluded that:

Accordingly, the Court found that the payment from the third party to the creditor could not have been a payment ‘from the company’ as it did not result in a reduction of the assets of the company that were available to creditors.

As noted above there must be a reduction or diminution of assets from the company in order for the transaction to fall within the criteria of an unfair preference. In these proceedings, it was originally held that it had not been shown that Rock Developments (the third party) was indebted to Eliana (the company in liquidation). If indebtedness had been shown, this would have meant:

‘that the payment made by Rock reduced its debt to Eliana and gave Mad Brothers the benefit of moneys to which Eliana was entitled. The payment would therefore have reduced the value of the asset”, that asset being a debt payable to Eliana which a liquidator would ordinarily be able to recover, and this would therefore amount to a payment from Eliana.

In the appeal, the Court concluded that there was still insufficient evidence to support a finding that the third party did in fact owe a debt to the company in liquidation, and accordingly, there was no diminution of the assets of the company in liquidation.

This then begs the question why would Rock Developments pay a debt for which it was not liable? This may very well raise questions as to whether its director was acting in the bests interests of Rock Developments when causing it to make the payment and it may amount to a breach of directors’ duties.

This decision clarifies the position in relation to payments made by third parties and that such payments will not always necessarily amount to an unfair preference. This was held despite the fact that the company in liquidation authorised and ratified the payment by the third party to the unsecured creditor, and that both the third party and the company in liquidation were controlled by the same person.

That is, for a payment to be an unfair preference it must come ‘from the company’ and be accompanied by a corresponding diminution of the company’s assets that are available to creditors.

The unfair preference provisions are intended to ensure that the assets of a company in liquidation are not unfairly applied so as to give an advantage to some creditors – so this decision could potentially create a loophole for insolvent companies that may be considering paying one or more creditors ahead of others, so long as the payment is not “from the company”.

It will be interesting to see how other states and territories approach this Victorian decision and whether a similar approach will be adopted for the treatment of third party payments- so definitely watch this space.

McCabes has extensive experience in dealing with insolvency matters and can advise companies, creditors and third parties on unfair preference transactions and insolvency matters generally. Please do not hesitate to contact us today to discuss your situation.