The Residential Tenancies Amendment Act (NSW) and Residential Tenancies Amendment Regulation (2025) have introduced significant changes to residential tenancy laws in New South Wales which reshape the rights and responsibilities of landlords and tenants. These reforms, which took effect through stages on 31 October 2024 and 19 May 2025, aim to enhance tenant protections while clarifying landlord obligations.

The reforms introduce changes to five principal areas:

- “no grounds” Eviction;

- keeping of pets;

- rent payments;

- re-letting; and

- notice periods for termination.

The End of No Grounds Eviction

Landlords must now provide a valid and lawful reason to terminate a tenancy agreement, limiting the discretion previously afforded to landlords on grounds to evict a tenant.

There is now a limited set of circumstances under which termination is permitted, including:

- Breach of Agreement: The tenant has breached a term of the tenancy agreement.

- Sale of Property: The property is to be sold with vacant possession, or the landlord has entered into a contract for sale requiring the property to be vacant.

- Major Works or Demolition: The premises must be vacated to allow for substantial renovations, repairs, or demolition, which are scheduled to commence within two months of the termination date.

- Change of Use for Housing Programs: The property will be used under an affordable housing scheme, transitional housing program, NSW Government key worker housing scheme, or as purpose-built student accommodation, and the tenant is not eligible under the relevant program.

- Withdrawal from Rental Market: The property will not be used as a residential rental for a minimum period of 12 months.

- Owner or Family Occupation: The landlord or a close family member intends to occupy the premises as their principal place of residence for at least six months.

- End of Employment-Linked Tenancy: The tenancy is linked to an employment or caretaker arrangement which has since concluded.

Keeping Pets in a Rental Home

Landlords are now required to respond to a tenant’s request to keep a pet within 21 days. Failure to respond within this period results in deemed consent, allowing the tenant to keep the pet without conditions.

When responding to a pet application, a landlord may:

- grant unconditional consent;

- grant consent subject to reasonable conditions; or

- refuse consent, provided the refusal is based on lawful and reasonable grounds.

Lawful grounds for refusal include:

- there are more than 4 animals in the property;

- the property is unsuitable for the animal because of the fencing, or lack of open space, or because it would harm the animal’s welfare;

- that the animal will cause damage exceeding the rental bond;

- the landlord resides at the property;

- keeping the animal would contravene applicable laws, local council regulations, or community rules (noting that strata by-laws prohibiting pets are no longer valid); or

- the tenant has declined to accept a reasonable condition imposed by the landlord.

Rent Payments

Landlords are now obligated to offer tenants rent payment options that are both cost-free and convenient. These include:

- electronic bank transfer, and

- centrepay, a service administered by the Commonwealth Government.

These payment methods are classed as “prescribed methods” under the amended legislation. Tenants may choose alternative methods by mutual agreement; however, landlords may not mandate the use of a specific service provider.

Where a tenant opts for a prescribed method, landlords are prohibited from charging fees or recovering any associated costs. While rent payment methods may be changed by mutual agreement, landlords cannot refuse a tenant’s request to switch to a prescribed method.

From 31 October 2024, a 12-month restriction on rent increases was introduced to all residential tenancy agreements, including both new and existing leases. Specifically, rent must not be increased:

- within the first 12 months of a tenancy agreement; or

- more than once within any 12-month period.

Previously, this restriction applied only to periodic agreements and fixed-term leases of two years or more. The amended legislation now extends this protection to fixed-term leases of less than two years.

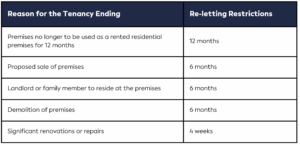

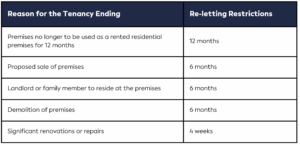

Re-letting

When a landlord terminates a lease for a lawful reason, there is now a mandatory waiting period before a new tenancy can begin. Refer to the table below for re-letting restrictions:

Notice Period

The landlord must provide the tenant with enough notice before terminating the lease. Following the legislative changes, the amount of notice required is:

- Periodic lease: at least 90 days.

- Fixed-term lease (6 months or less): at least 60 days’ notice; and the end date must be after the fixed term.

- Fixed-term lease (more than 6 months): at least 90 days’ notice; and the end date must be after the fixed term.

Contributors:

- Daniel Weissel, Senior Associate

- Sarah Sassine, Lawyer